For decades, sending money across borders has been plagued by slow transfers, high fees, and unnecessary friction.

Meanwhile, fintechs and crypto-native solutions are proving that fast, seamless, and low-cost global payments are not just possible — they’re already here.

So why are traditional financial institutions, including credit unions, still struggling to keep up?

The Cross-Border Payments Challenge:

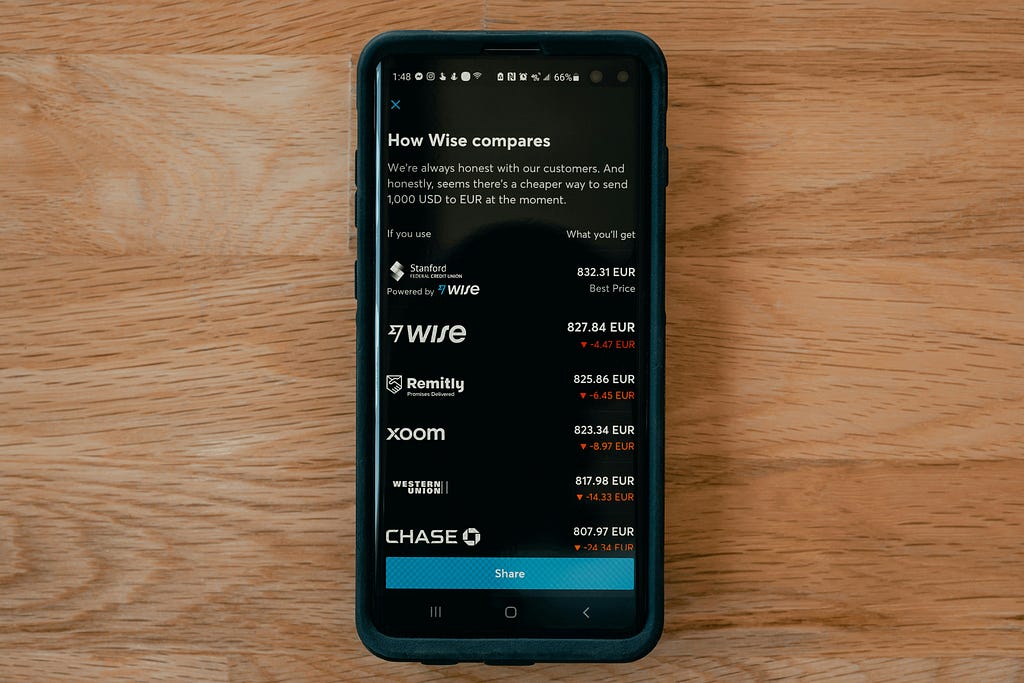

Credit unions have long been a trusted financial partner for their members, but when it comes to international transactions, the legacy systems they rely on are often inefficient — The typical cross-border payment process involves multiple intermediaries, lengthy settlement times, and costly fees that eat into the transaction value.

In contrast, fintech companies and blockchain-based solutions are setting a new standard — offering near-instantaneous, low-cost global transfers without the traditional red tape.

This shift is forcing financial institutions to rethink their approach to cross-border payments, or risk falling behind.

How Can Credit Unions Compete?

While fintechs and crypto platforms have taken the lead in cross-border payments, credit unions have an opportunity to leverage these same technologies to enhance their offerings. Here’s how:

1. Adopt Faster Payment Infrastructure

Credit unions can integrate with modern, real-time payment networks and blockchain-powered rails to speed up transactions and reduce costs.

2. Leverage Stablecoins and Digital Assets

Stablecoins provide a bridge between traditional and decentralized finance, enabling secure and rapid international transactions without the volatility of other cryptocurrencies.

3. Reduce Intermediaries with Blockchain/DLT

By using blockchain for settlements, credit unions can minimize the need for third-party intermediaries, cutting down processing times and costs.

4. Offer Competitive Foreign Exchange (FX) Rates

Fintechs and crypto solutions often provide better exchange rates than traditional banks. Credit unions can improve their FX services by partnering with innovative providers that offer dynamic, cost-efficient conversions.

The Time to Act is Now

The financial landscape is evolving rapidly. Credit unions that fail to modernize their cross-border payment services risk losing members to fintechs and decentralized alternatives that offer better, faster, and cheaper solutions.

But it doesn’t have to be this way.

By embracing emerging technologies and forming strategic partnerships, credit unions can position themselves at the forefront of payment innovation — providing their members with the seamless global transactions they need.

Is your credit union ready to compete?

Let’s build the future of payments together https://www.banksocial.io/connect#get-in-touch

#FutureOfPayments #CreditUnionInnovation #GlobalTransfers

View more

View more